Southeast Insights

Your go-to source for news and information from the vibrant heart of Shenyang.

Staking Your Claim: The Quirky World of Crypto Staking Systems

Discover the quirky side of crypto staking systems! Learn how to maximize your earnings while having fun in the wild world of crypto!

Understanding the Mechanics of Crypto Staking: How to Maximize Your Earnings

Understanding the process of crypto staking is essential for anyone looking to maximize their earnings in the ever-evolving world of cryptocurrency. Staking is a method used by various blockchain networks to validate transactions and secure the network while allowing users to earn rewards. The mechanics involve locking up a specific amount of cryptocurrency, which then contributes to the network's operations. In return, participants receive staking rewards, often paid in the same cryptocurrency, making it a win-win situation. However, the specifics can differ across different platforms, so it's crucial to research which cryptocurrencies offer the best annual percentage yield (APY).

To maximize your earnings from crypto staking, consider the following strategies:

- Diversify your portfolio: By staking multiple cryptocurrencies, you can mitigate risks and benefit from various networks' performance.

- Research validator nodes: Selecting reputable validator nodes with a strong track record can lead to higher rewards.

- Stay informed: Follow the latest developments in the crypto space, as changes in protocols or market conditions can impact staking rewards significantly.

Counter-Strike, a popular team-based first-person shooter, has captured the hearts of gamers worldwide since its inception. Players engage in tactical gameplay, focusing on strategy and teamwork. To enhance their gaming experience, many look for advantages like a rollbit promo code to access exclusive rewards and boosts.

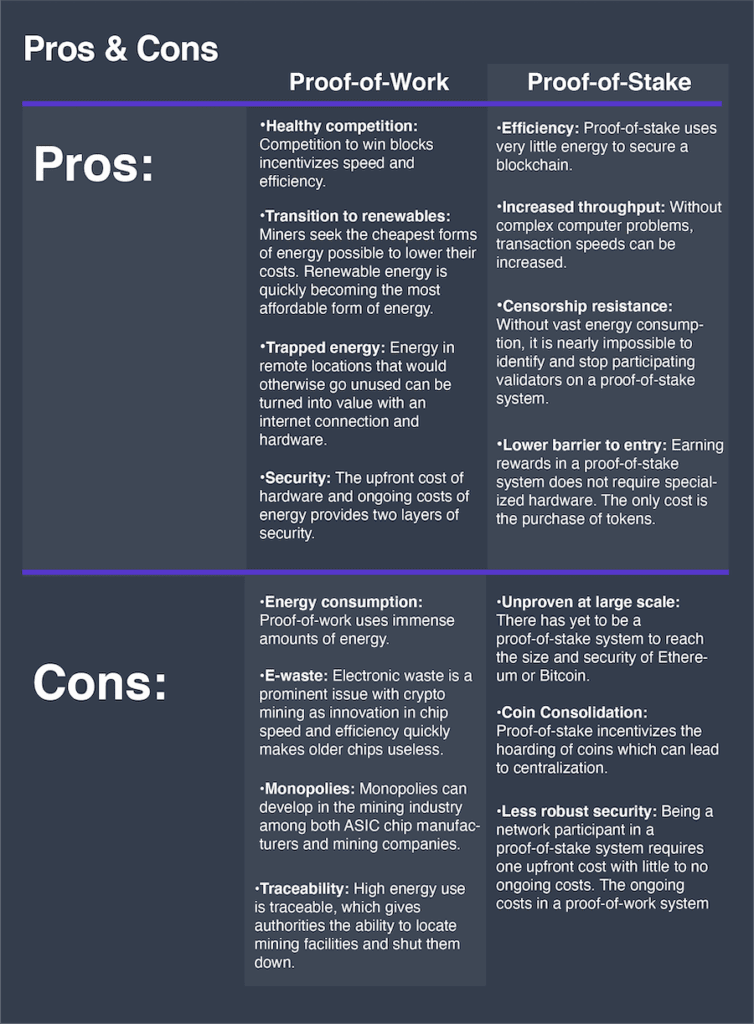

The Pros and Cons of Different Staking Platforms: Which One Is Right for You?

When exploring the pros and cons of different staking platforms, it's essential to consider factors such as user experience, fees, and security. Some platforms offer a user-friendly interface, making it easier for newcomers to get started with staking. For instance, platforms like Binance or Kraken provide an intuitive layout and comprehensive guides. However, while these platforms may excel in usability, they could have higher fees compared to decentralized options like Ethereum 2.0 staking. Additionally, users should be aware of the security measures in place; some platforms have a history of hacks or exploits that could jeopardize your funds.

On the other hand, decentralized staking platforms, such as Cardano or Polkadot, tend to provide more control and transparency. These platforms typically allow users to participate directly in the network, potentially earning higher yields. However, they often come with a steeper learning curve and less customer support. Overall, the right staking platform for you depends on your experience level and financial goals. If you're a beginner looking for ease of use, a centralized platform might be best, while more experienced users may prefer the control offered by decentralized options.

Is Crypto Staking Worth It? Exploring Risks and Rewards for New Investors

As the cryptocurrency market continues to evolve, crypto staking has emerged as a popular investment strategy for many new investors. By locking up their assets in a staking process, participants can earn rewards in the form of additional cryptocurrency. However, the question remains: Is crypto staking worth it? On one hand, staking can provide an attractive return on investment, often yielding higher annual percentage rates (APRs) compared to traditional savings accounts. On the other hand, there are inherent risks involved, such as market volatility and the possibility of losing staked assets due to unforeseen circumstances. Therefore, it's essential to weigh the potential benefits against the risks before diving in.

For those considering crypto staking, it’s vital to take into account several factors:

- Project Reputation: Opt for projects with a well-established history and a strong community.

- Payout Structure: Understand how and when rewards are distributed, as some projects have locking periods.

- Security Measures: Ensure you are using a secure wallet and consider any smart contract vulnerabilities.