Southeast Insights

Your go-to source for news and information from the vibrant heart of Shenyang.

Term Life Insurance: The Safety Net Nobody Talks About

Discover why term life insurance is the ultimate safety net you've overlooked—secure your loved ones and find peace of mind today!

Understanding Term Life Insurance: Key Benefits and Features

Term life insurance is a straightforward and affordable type of life insurance that provides coverage for a specified period, typically ranging from 10 to 30 years. One of the key benefits of term life insurance is its cost-effectiveness; premiums are generally lower than those of permanent life insurance policies. This makes it an ideal choice for young families or individuals looking to secure financial protection during crucial years, such as when raising children or paying off a mortgage. Additionally, many policies offer flexibility in choosing the term length, allowing policyholders to select coverage that aligns with their specific financial obligations.

Another significant feature of term life insurance is the simplicity of its structure. There are no complicated investment components, and the payout, known as the death benefit, is typically straightforward and tax-free for beneficiaries. Furthermore, many insurers offer options to convert a term policy into a permanent policy without the need for a medical exam, which can be beneficial as health conditions change over time. It's essential for consumers to understand both the benefits and limitations of term life insurance, ensuring they select a policy that meets their long-term financial goals.

Is Term Life Insurance Right for You? Common Questions Answered

Deciding whether term life insurance is right for you involves evaluating your financial obligations and goals. This type of policy provides coverage for a specific period, typically ranging from 10 to 30 years, making it ideal for those looking to safeguard their loved ones during critical years. Some common reasons individuals opt for term life insurance include paying off a mortgage, funding children's education, or covering other significant debts. Before making a decision, consider your current financial situation and whether you anticipate any major changes that could affect your insurance needs.

Many people have questions when considering term life insurance. Here are some of the most frequently asked:

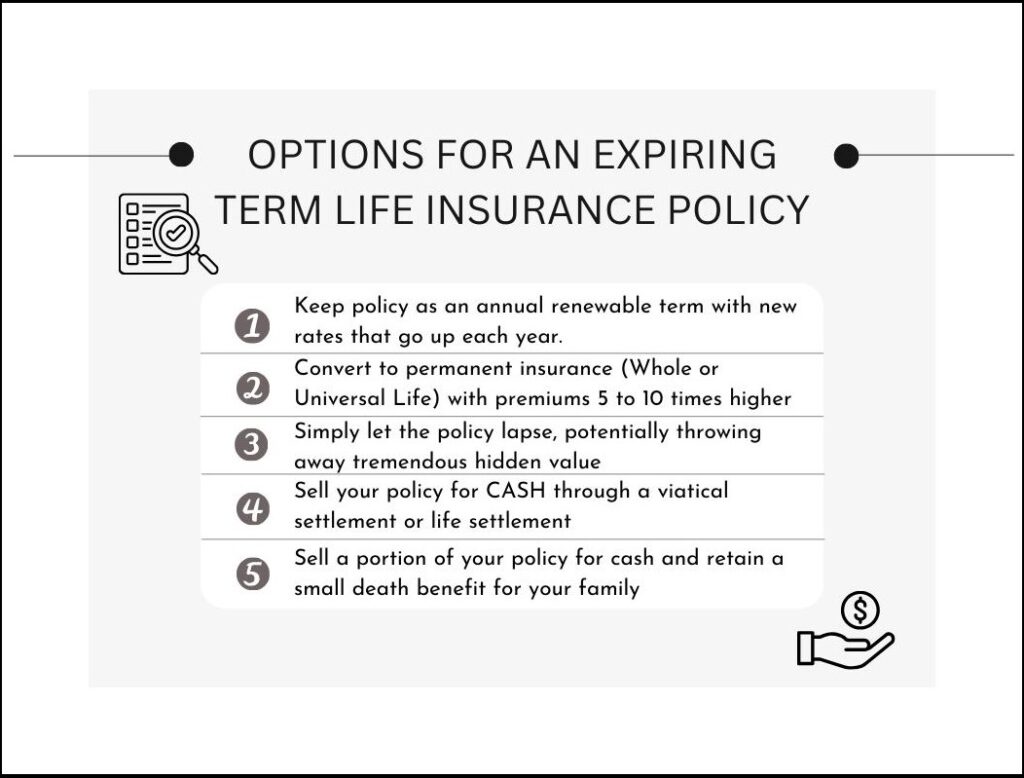

- What happens if I outlive my term? The policy will expire, and you will not receive any benefits unless you convert to a permanent policy.

- Can I renew my term policy? Yes, many term policies offer renewal options, typically at a higher premium.

- Is this insurance type suitable for younger individuals? Absolutely! Young, healthy individuals often enjoy lower premiums, making term life insurance a cost-effective choice.

The Hidden Benefits of Term Life Insurance: What You Should Know

Term life insurance is often viewed as a straightforward financial product designed to provide coverage for a specific period, typically ranging from 10 to 30 years. However, beyond its primary function of offering death benefits, there are several hidden benefits that policyholders may overlook. For instance, many insurers allow policyholders to convert their term policy to a permanent one without undergoing additional health assessments. This feature can be particularly advantageous for those who may face health issues later in life, providing a safety net for continued coverage.

Additionally, term life insurance can serve as a savvy financial planning tool. It not only offers peace of mind but can also fit neatly into a broader investment strategy. By locking in a lower premium while young and healthy, individuals can allocate their savings towards other investments, knowing that their loved ones are financially protected. Some policies even offer riders that allow for accelerated death benefits, enabling policyholders to access funds in the event of a terminal illness, further enhancing its value beyond mere coverage.