Southeast Insights

Your go-to source for news and information from the vibrant heart of Shenyang.

Saving Big on Coverage: The Hidden Discounts!

Unlock the secrets to massive savings on insurance! Discover hidden discounts that can trim your coverage costs today!

Unlocking Savings: Essential Discounts You Might Be Missing on Your Insurance

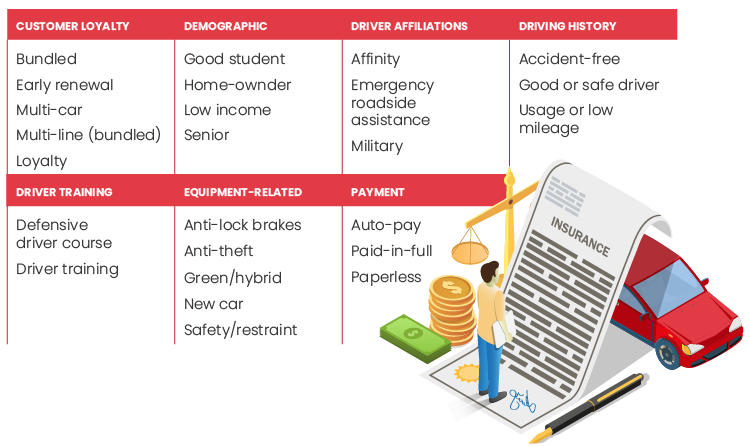

Many individuals are unaware of the range of discounts that can significantly lower their insurance premiums. For instance, you might qualify for a multi-policy discount if you bundle your home and auto insurance with the same provider. Additionally, some insurers offer discounts based on your driving habits. Utilizing telematics devices can demonstrate safe driving and ultimately earn you savings. Don't forget about discounts for new vehicles equipped with advanced safety features, as these can further enhance protection and reduce costs.

Moreover, certain lifestyle choices can lead to insurance savings that are often overlooked. For example, maintaining a good credit score can qualify you for lower rates. Check if your insurance provider offers a credit score discount. Additionally, some insurance companies provide discounts for members of specific organizations or alumni groups. Make sure to inquire with your agent about any available discounts that may be applicable to your situation. Staying informed can ensure you are not missing out on valuable savings!

How to Maximize Your Coverage Without Breaking the Bank: Discover Hidden Discounts!

In today's financial landscape, managing expenses while ensuring adequate coverage can be a daunting task. However, it is possible to maximize your coverage without breaking the bank by exploring various hidden discounts available in the market. Financial experts recommend starting with a thorough review of your current policies to identify potential areas for savings. This includes checking for bundled insurance packages that can offer substantial discounts or taking advantage of loyalty programs that reward long-term customers.

Additionally, consider leveraging technology to uncover exclusive discounts tailored to your needs. Several websites provide comparison tools, enabling you to analyze different policies side by side. Furthermore, do not overlook the value of working with local agents who might have access to discounts not widely advertised. For instance, Insure.com lists various discounts related to good driving records, low mileage, or even student status. By being proactive and doing your research, you can discover hidden discount opportunities that empower you to secure the best coverage at an affordable cost.

Are You Missing Out? Uncover the Top Insurance Discounts Most People Overlook

In the world of insurance, many consumers unknowingly miss out on significant savings due to a lack of awareness about available discounts. Insurance discounts can vary widely among providers, and knowing which ones apply to you can lead to substantial reductions in your premium costs. For instance, did you know that bundling multiple policies — such as home and auto insurance — often nets you a multiline discount? Additionally, many insurers offer discounts for safe driving records or for installing security features in your home, which you may be able to claim simply by asking your agent.

Moreover, there are often lesser-known discounts that can benefit specific groups. For example, military personnel, teachers, and even seniors frequently qualify for discounts that are not universally advertised. Another option to explore is the loyalty discount, which rewards long-term customers or those who maintain multiple policies with the same insurer. Don’t hesitate to ask your agent about these opportunities; you might be surprised at how much you can save!