Southeast Insights

Your go-to source for news and information from the vibrant heart of Shenyang.

Saving Green in Your Home

Unlock the secrets to saving green in your home! Discover simple tips for cutting costs and boosting energy efficiency today!

10 Simple Ways to Save Green at Home

In today's world, finding ways to save green at home is not only beneficial for your wallet but also for the environment. Here are 10 simple ways that can help you reduce your expenses while supporting sustainable living:

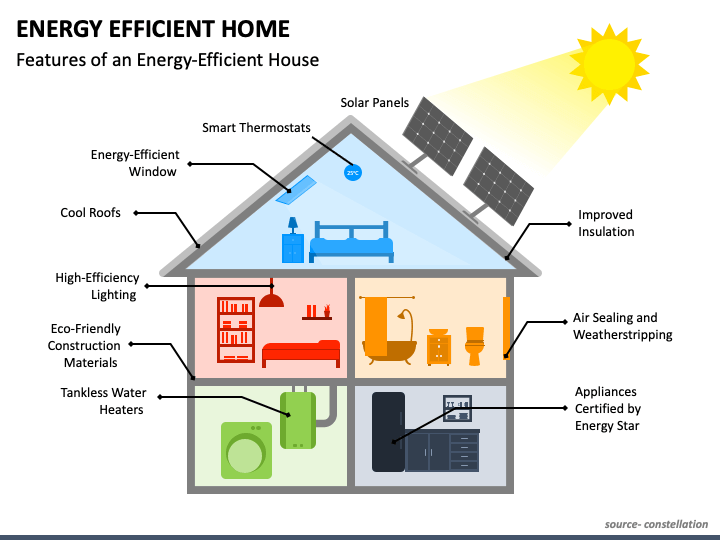

- Start by replacing traditional bulbs with energy-efficient LED lights. This small change can lead to substantial savings on your electricity bill.

- Implement a programmable thermostat to maintain your home's temperature without unnecessary energy consumption.

- Practice mindful water usage by fixing leaks and installing low-flow fixtures, which contribute to both savings and conservation.

Another effective method to save green at home is to reduce waste. Consider composting organic waste and recycling materials to minimize your trash output. Additionally, adopting a meal planning routine can help you avoid over-purchasing groceries, leading to less spoilage and more money saved. Lastly, start a household budget to track your spending, enabling you to identify areas where you can cut back and ultimately save more green.

How Energy-Efficient Appliances Can Cut Your Bills

In today's world, where energy conservation is a growing concern, energy-efficient appliances are becoming essential for homeowners. These appliances are designed to use less energy while still providing the same level of performance as their traditional counterparts. By investing in products that have the Energy Star label, you can significantly reduce your monthly energy bills. For example, using an energy-efficient refrigerator can lower your energy usage by 15-20%, allowing you to save more money over time.

Additionally, energy-efficient appliances not only benefit your wallet but also contribute positively to the environment. By consuming less electricity, you reduce your carbon footprint, leading to a more sustainable lifestyle. To maximize savings, consider replacing older appliances that consume more energy without delivering better performance. Switching to energy-efficient models can be a smart financial decision that yields considerable long-term benefits. In fact, it’s often possible to recoup the initial investment through the savings on your utility bills within a few years.

Is Your Home Making You Poor? Signs You're Not Saving Enough

Your home is more than just a shelter; it's a significant financial commitment that can either help or hinder your savings. If you find yourself living paycheck to paycheck despite a steady income, it might be time to evaluate your current living situation. Signs you're not saving enough can be subtle, yet glaring. For instance, constantly dipping into savings to cover home-related expenses could indicate that your mortgage, utilities, or maintenance costs are too high for your budget. Take a moment to assess your financial health—if your home is draining your resources, it may be time to consider downsizing or relocating to a more affordable area.

Another red flag is the accumulation of debt tied to home ownership. If you're relying on credit cards or loans to meet your housing costs or to fund necessary repairs, this cycle can lead to long-term financial instability. To identify if your home is making you poor, look for these warning signs:

- Frequent late payments on mortgage or utilities.

- Increasing credit card balances.

- Limited funds left after monthly expenses.